I’ve been a Pandora listener since it was launched in 2005. I listen at the office on my laptop. I sync my iPhone app in the car, and connect my iPad to an external speaker at home when I’m working around the house. It has become such a part of my normal routine that I sometimes forget that not everyone is as familiar with Pandora. Much less, its growth rates and local advertising options.

So tonight when I ran across a mention that it’s been 13 years since The Music Genome Project was created that intimately became Pandora, I decided to review some of current stats and developments.

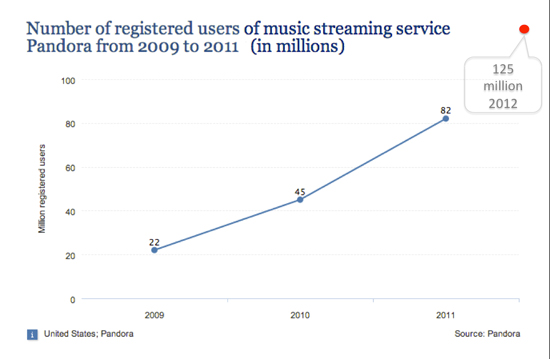

Pandora currently has over 125 million registered users, that’s up from 82 million in 2011.

In December 2012, Pandora had 67 million active listeners. Active listeners are defined as the number of distinct registered users that have requested audio from Pandora’s servers within the trailing 30 days.

Active users listen to Pandora an average of 20 hours per month.

As a total share of radio listening in December 2012, Pandora accounted for 7.19 percent, versus 4.71 percent in December 2011, and active listeners increased 41 percent year-over-year.

Users listened to over 13 billion hours of music in 2012, and created over 1.6 billion stations.

Users listened to over a million different songs by over 100,000 different artists during the year.

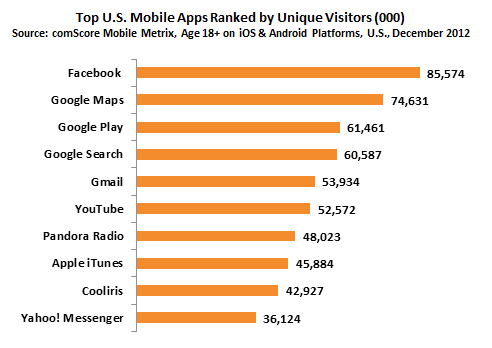

More than 80 percent of listeners use the service on their mobile devices making Pandora one of the most heavily indexed major U.S. media property on mobile devices, according to a recent study from ComScore.

A big part of Pandora’s continued growth is its integration into other devices. It is integrated in more than 1,000 products as of the recent Consumer Electronics Show, including consumer electronics devices ranging from Blu-ray players to a refrigerator made by Samsung. And more than 85 car models that have the Internet radio service integrated into their entertainment systems.

Autos is an interesting market move for Pandora because Sirius XM has its satellite radios in 70 percent of new vehicles. Sirius generates the vast majority of its revenue (some $3 billion) primarily through subscriptions while Pandora is the opposite, collecting most of its revenue from advertising. However, the migration of audiences to mobile devices threatens to upend a market that Sirius current dominates.

From an advertising perspective, Pandora has the ability to target consumers with far greater precision than terrestrial radio. It can pinpoint listeners by age and sex, ZIP code or even musical taste. That targetability of its ads means it’s an attractive alternative for local businesses.In some markets, Pandora’s reach is estimated to be higher than other local stations. And in the future we may have some measurement tools that provide a clearer comparison as Nielsen’s President of Global Media Products stated in December, that before long, advertisers will be able to see Arbitron ratings for radio and Pandora side-by-side.

So it’s no surprise that a key corporate strategy for Pandora is competing with local terrestrial broadcasters for a chunk of radio’s $17 billion ad market. Ad revenue for online radio is expected to soar 67 percent, from $900 million in 2012 to $1.5 billion in 2016. But over the same period, terrestrial radio’s take will advance only around 4 percent, to $16.5 billion. To a degree, terrestrial and online radio ads are increasingly being counted as part of the same “audio” category, which implies a zero-sum game.